HARDIN COUNTY COMMUNITY FOUNDATION STATEMENT OF ASSETS

| Assets: | 1999 | 2000 | 2001 | 2002 |

|

Cash, including stocks, certificates of deposits |

$823,120.54 | $832,915.82 | $883,598.42 | $975,895.74 |

|

|

2003 | 2004 | 2005 | 2006 |

|

|

$1,927,885.93 | $2,026,510.34 | $2,459,216.84 | $2,636,949.09 |

|

|

2007 | 2008 | 2009 | 2010 |

|

|

$2,875,623.54 | $2,473,444.05 | $2,807,198.47 | $4,369,641.00 |

|

|

2011 | 2012 | 2013 | 2014 |

|

|

$4,306,754.00 | $4,596,458 | $5,265,527 | $5,517,739 |

|

|

2015 | 2016 | 2017 | 2018 |

|

|

$5,722.594 | $6,016,895 | $6,793,770 | $6,391,022 |

|

2019

|

2020 | 2021 | 2022 | |

|

$8,425,399

|

$9,649,805 | $10,963,405 | $9,489,301 | |

|

2023

|

||||

|

$11,684,033

|

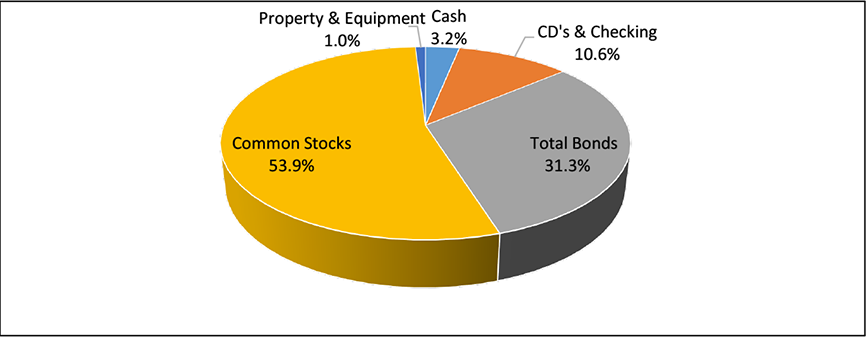

Asset Allocation and Values as of 12/31/2023

Current Asset Allocation

| Current Asset Allocation | ||

|

Asset Type |

Mkt.Value | % of Portfolio |

| "Cash" @ Stratos | $371,929 | 3.2% |

| CD's & Checking | $1,243,666 | 10.6% |

| CD's @ Stratos | 0.0% | |

| US Treasury Bonds | $2,090,477 | 17.9% |

| US Govt. Agencies | 0.0% | |

| Corp.Bonds | $1,563,336 | 13.4% |

| Total Bonds | $3,653,813 | 31.3% |

| Common Stocks | $6,302,987 | 53.9% |

| Property & Equipment | $111,638 | 1.0% |

| Managed Funds | 0.0% | |

| Total Portfolio | $11,684,033 | 100.0% |

| Stratos Managed | Total | |

| 12/31/2023 | $10,328,729 | $11,684,033 |

| 9/30/2023 | $9,347,583 | $9,981,508 |

| 6/30/2023 | $9,685,397 | $10,352,056 |

| 3/31/2023 | $9,318,798 | $10,043,727 |

| 12/31/2022 | $8,776,998 | $9,489,301 |

| 9/30/2022 | $8,387,496 | $9,045,522 |

| 6/30/2022 | $8,699,251 | $9,358,636 |

| 3/31/2022 | $9,470,184 | $10,461,953 |

| 12/31/2021 | $10,176,341 | $10,963,405 |

| 9/30/2021 | $9,525,371 | $10,399,617 |

| 6/30/2021 | $9,509,533 | $10,368,980 |

| 3/31/2021 | $9,230,022 | $9,882,438 |

| 12/31/2020 | $8,799,966 | $9,649,805 |

| 9/30/2020 | $8,071,383 | $8,761,830 |

| 6/30/2020 | $7,564,531 | $8,232,770 |

| 3/31/2020 | $6,751,500 | $7,412,772 |

| 12/31/2019 | $7,747,532 | $8,425,399 |

| 9/30/2019 | $6,434,110 | $7,126,871 |

| 6/30/2019 | $6,340,352 | $7,030,661 |

| 3/31/2019 | $6,293,214 | $6,881,705 |

| 12/31/2018 | $5,780,534 | $6,391,022 |

| 9/30/2018 | $6,415,252 | $7,016,643 |

| 6/30/2018 | $6,114,547 | $6,707,727 |

| 3/31/2018 | $6,042,904 | $6,787,201 |

| 12/31/2017 | $6,078,973 | $6,793,770 |

| 9/30/2017 | $5,798,873 | $6,494,406 |

| 6/30/2017 | $5,591,785 | $6,241,755 |

| 3/31/2017 | $5,432,550 | $6,299,996 |

| 12/31/2016 | $5,220,790 | $6,016,895 |

| 9/30/2016 | $5,078,217 | $5,791,296 |

| 6/30/2016 | $4,936,819 | $5,651,558 |

| 3/31/2016 | $4,916,755 | $5,740,516 |

|

12/31/2015 |

$4,903,823 | $5,722,594 |

| 9/30/2015 | $4,706,071 | $5,391,209 |

| 6/30/2015 | $4,955,241 | $5,664,053 |

| 3/31/2015 | $4,948,722 | $5,852,455 |

| 12/31/2014 | $4,773,147 | $5,517,739 |

| 9/30/2014 | $4,249,537 | $5,324,333 |

| 6/30/2014 | $4,644,481 | $5,320,305 |

| 3/31/2014 | $4,637,670 | $5,367,060 |

| 12/31/2013 | $4,568,789 | $5,265,527 |

| 9/30/2013 | $4,249,537 | $4,924,003 |

| 6/30/2013 | $4,097,116 | $4,773,471 |

| 3/31/2013 | $4,155,651 | $4,871,978 |

| 12/31/2012 | $3,883,834 | $4,596,458 |

| 9/30/2012 | $3,905,242 | $4,600,723 |

| 6/30/2012 | $3,736,077 | $4,434,665 |

| 3/31/2012 | $3,948,512 | $4,633,032 |

| 12/31/2011 | $3,620,684 | $4,306,754 |

| 9/30/2011 | $3,351,150 | $4,021,137 |

| 6/30/2011 | $3,745,488 | $4,296,662 |

| 3/31/2011 | $3,954,425 | $4,531,287 |

| 12/31/2010 | $3,796,681 | $4,369,641 |

| 9/30/2010 | $2,242,242 | $2,806,821 |

| 6/30/2010 | $2,623,030 | $2,623,030 |

| 3/31/2010 | $2,32,355 | $2,909,835 |

| 12/31/2009 | $2,224,999 | $2,807,198 |

| 9/30/2009 | $2,165,257 | $2,725,523 |

| 6/30/2009 | $1,967,364 | $2,729,932 |

| 12/31/2008 | $1,821,943 | $2,473,445 |

| 12/31/2007 | $2,224,873 | $2,875,625 |

| 12/31/2006 | $2,054,377 | $2,636,950 |

| 12/31/2005 | $1,874,064 | |

| 12/31/2004 | $1,447,946 | |

Financial Statement

Notes to Financial Statements

Fund Accounting

The financial statements are presented in accordance with the principles of fund accounting, whereby revenues and disbursements are classified into funds according to their nature and purpose.

The Foundation records its activities in the following funds.

Field of Interest Funds allow donors to support a broad area of concern such as the arts, education, health care, or services for children. The Foundation awards grants to programs or organizations that are most likely to achieve positive results for that area of interest.

Designated Funds support specific charitable organizations identified by the donor. If the named charity is no longer active or providing a needed service, another organization with a similar purpose is selected by the Governing Committee to receive the grant.

Scholarship Funds can be designated for any level of education, from preschool to postgraduate work. Donors may designate a particular field of study, select eligibility requirements, and name an advisory committee.

Administrative Funds support the ongoing operation of the Hardin County Community Foundation.